Transfer Princing

The globalization of the economy and the increasing scrutiny of intra-group transactions highlight the importance of a transfer pricing policy that is appropriate to each situation, in order to optimize the tax burden of the group as a whole.

Baker Tilly's Transfer Pricing team has extensive national and international experience in the area, as well as access to the Baker Tilly network of experienced professionals around the world.

Timely and careful optimization, in addition to ensuring efficient compliance with transfer pricing rules, can represent an opportunity to achieve greater tax and financial efficiency.

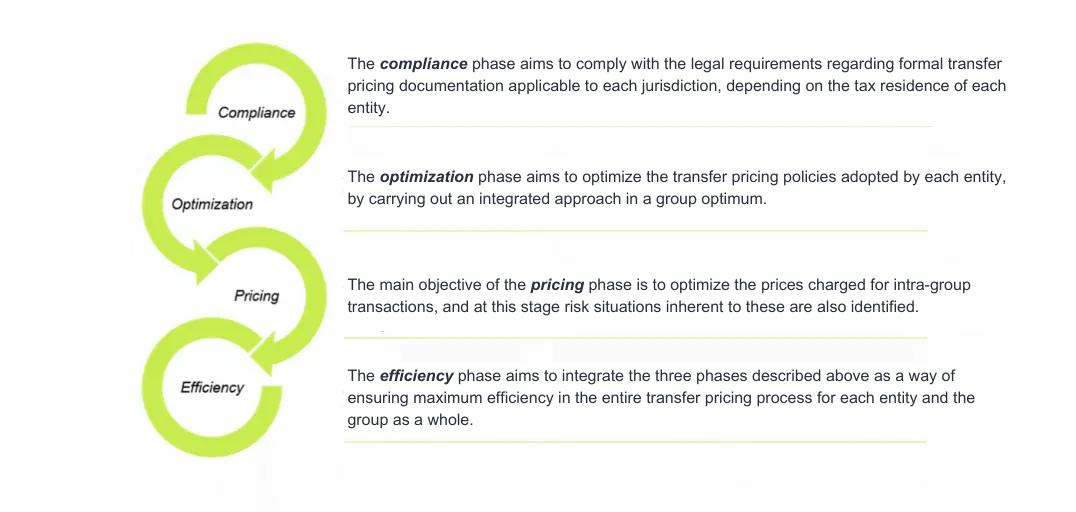

Baker Tilly carries out its work in accordance with the COPE methodology:

Contacts